.png)

What a Student Entrepreneur Should Know About Employment Tax

Federal Employment Taxes

There are 5 General Types of Federal Taxes that the Business Will be Expected to Pay

-

Income Tax

-

Estimated Tax

-

Self Employment Tax

-

Employment Tax

-

Federal Insurance Contribution Act (FICA)

-

Social Security Tax & Medicare Tax

-

-

Federal Income Tax Withholding

-

Federal Unemployment Tax Act (FUTA)

5. Excise Tax

Employer Identification Number

Getting Started

THE EIN

If you are required to report employment taxes or give tax statements to employees, you need an Employer Identification Number.

Businesses need to file for a Federal Employer Identification Number or EIN if they report "yes" to any of the following questions.

Do you have employees?

Do you operate your business as a corporation or a partnership?

Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms?

Do you withhold taxes on income, other than wages, paid to a non-resident alien?

Do you have a Keogh plan?

Are you involved with any of the following types of organizations, instruments, or entities?

-

Trusts, except certain grantor-owned revocable trusts, IRAs, Exempt Organization Business Income Tax Returns

-

Estates

-

Real estate mortgage investment conduits

-

Non-profit organizations

-

Farmers’ cooperatives

-

Plan administrators

What is an EIN?

The EIN is a nine-digit number issued by the IRS and is arranged as follows: 00-0000000. It is used to identify tax accounts of employers and certain others who have no employees. Corporations, Partnerships, and Limited Liability Corporations (LLC) are required to have one. Sole Proprietors and DBAs (Doing Business As) are not required to have one and can use their social security number instead. The EIN should be used on all items sent to the IRS and SSA. If an employer does not have an EIN, you can apply for one online or you can fax or mail an SS-4 form to the IRS.

Federal Insurance Contribution Act (FICA)

"The Federal Insurance Contributions Act (FICA) is a U.S. law that mandates a payroll tax on the paychecks of employees, as well as contributions from employers, to fund the Social Security and Medicare programs" (Kagan, 2020).

-

Who is exempt?

-

"Certain religious groups, students, U.S. citizens who decide to forfeit their national citizenship, employees of foreign governments" (Segal, 2020).

-

(“Social Security", 2017).

Social Security Tax

-

Employees and employers share the social security tax equally.

-

Each must pay 6.2% toward social security up to a cap of $137, 700 per year per person.

-

After an employee earns $137, 700 no additional social security taxes are taken out of the employee's paycheck.

-

-

-

The government adjusts the cap each year based on salary level changes in the market place. (Epstein, n.d.)

Example

An employee who makes $1,000 in a pay period

$1,000 x 0.062= $62

$62 would be deducted from the employee's gross pay and the company would also pay $62. Thus, the total amount submitted in social security taxes for this employee is $124

(Epstein, n.d.)

Medicare Tax

-

Employees and employers also share Medicare Taxes which are 1.45% each pay period.

-

Unlike social security tax, the federal government places no caps on the amount that must be paid in Medicare Taxes.

-

-

The Affordable Care Act added an additional Medicare tax of 0.9% on anyone with an earned income of more than $200,000 ($250,000 for married couples filing jointly) beyond the standard 1.45%.

-

The employee is responsible for the entire 0.9%. It is not split between the employer and the employee. (Epstein, n.d.)

-

Example

An employee who makes $1,000 in a pay period

$1,000 x 0.0145= $14.50

$14.50 would be taken deducted from the employee's gross pay and the company pays employer's share of $14.50. Thus, the total amount submitted in Medicare Taxes for this employee is $29.

(Epstein, n.d.)

Federal Income Tax Withholding

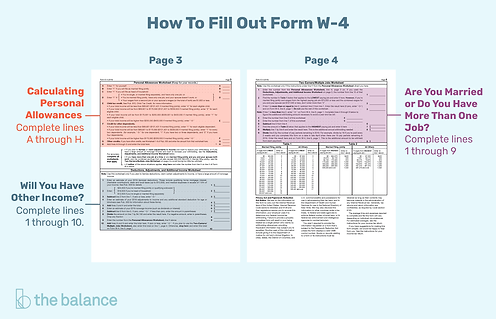

"For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4" (“Tax Withholding", 2020).

When an employer hires an employee, the employee will fill out a W4. This document is an IRS form that informs the employer of how much money to withhold from an employee's paycheck for federal taxes. The W4 will disclose the employee's filing status, multiple jobs, adjustments, amount of allowances, amount of other income, amount of deductions and any additional amount to withhold from each paycheck.

(Epstein, n.d.)

(Perez, 2019).

How is Federal Income Tax Withholding Calculated?

-

3 Methods

-

Percentage Method

-

Wage Bracket Method

-

Tax Withholding Assistant

-

Percentage Method

-

Publication 15 will provide you with a Percentage Method table.

-

This table is broken down by the pay period

-

Ex. Weekly, bi-weekly etc.

-

-

-

Multiply the amount of withholding allowances indicated on the W4 by the withholding allowance for the payroll period.

-

Take this amount and subtract it from your wages for the pay period

-

Find what range this amount falls under in the Percentage Method withholding tables

-

Make sure you are looking at the percentage table for you pay period and status.

-

-

The table will tell you how much you owe in federal withholding tax.

-

Then subtract that amount by the excess amount and multiple the remainder by the given percentage

-

-

(Perez, 2019).

Wage Bracket Method

-

Need to know

-

Marital Status

-

Number of Allowances

-

Pay Period

-

Amount of Wages

-

-

Look at the wage range

-

Match up wage range with filling status, number of allowances and pay period

Determining Employment Tax Obligation on Federal Level

-

The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees’ wages. It will help you as you transition to the new Form W-4 for 2020.

-

Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your employees’ income tax withholding. If you use an automated payroll system, you do not need to use the Assistant.

-

The Tax Withholding Assistant is available in Excel format.

-

Download the

Excel Spreadsheet -

Open the Tax Withholding Assistant and follow these steps to calculate your employees’ tax withholding for 2020. Be sure that your employee has given you a completed Form W-4. The Assistant can accommodate both the 2020 Form W-4 and Forms W-4 from prior years.

-

You will want to save a separate copy of the spreadsheet for each employee.

-

Indicate how frequently you pay your employee.

-

Specify which version of Form W-4 applies to the employee.

-

Enter the requested information from your employee’s Form W-4.

-

Save a copy of the spreadsheet with the employee’s name in the file name.

-

Each pay period, open each employee’s Tax Withholding Assistant spreadsheet and enter the wage or salary amount for that period. The spreadsheet will then display the correct amount of federal income tax to withhold.

When to File FICA and Federal Withholding Tax

"If you paid wages subject to income tax with- holding (including withholding on sick pay and supple- mental unemployment benefits) or social security and Medicare taxes, you must file Form 941 quarterly even if you have no taxes to report, unless you filed a final return, you receive an IRS notification that you’re eligible to file Form 944" (United States, 2020).

Also, if you’re required to file Forms 941 but believe your employment taxes for the calendar year will be $1,000 or less, and you would like to file Form 944 instead of Forms 941, you must contact the IRS during the first calendar quarter of the tax year to request to file Form 944. You must receive written notice from the IRS to file Form 944 instead of Forms 941 before you may file this form (United States, 2020).

For each month or partial month you are late filing Form 941, the IRS imposes a 5 percent penalty, with a maximum penalty of 25 percent. This penalty is a percentage of the unpaid tax due with the return (United States, 2020).

When to File FICA and Federal Withholding Tax

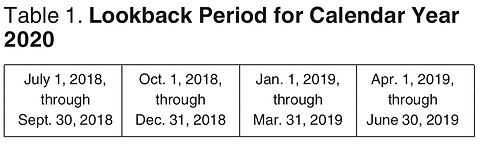

"There are two deposit schedules-monthly and semiweekly- for determining when you deposit Social Security, Medicare, and withheld federal income taxes. Before the beginning of each calendar year, you must determine which of the two deposit schedules you're required to use"

"The deposit schedule you must use is based on the total tax liability you reported on Form 941 during a 4-quarter look-back period. The look-back period begins July 1 and ends June 30. If you reported $50,000 or less of taxes for the look-back period, you're a monthly schedule depositor; if you reported more than $50,000, you're a semiweekly schedule depositor"

"Under the monthly deposit schedule, deposit employment taxes on payments made during a month by the 15th day of the following month"

"Under the semiweekly deposit schedule, deposit employment taxes for payments made on Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payment made on Saturday, Sunday, Monday, and/or Tuesday by the following Friday"

"Generally, employees are required to file Forms 941 quarterly. However, some small employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less for the year) may file Form 944 annually instead of Form 941"

(United States, 2020).

(United States, 2020).

(United States, 2020).

Semiweekly Deposit Schedule

(United States, 2020).

Self-Employment Contributions Act

"The Self Employed Contributions Act (SECA) tax is a levy from the U.S. government on those who work for themselves, rather than for an outside company. It requires self-employed workers to contribute tax to pay both the employer and employee portions of the Federal Insurance Contributions Act (FICA) tax, which funds Social Security and Medicare. Self-employment tax is due when an individual has net earnings of $400 or more in self-employment income over the course of the tax year" (Kagan, 2020).

Who Qualifies as Self-Employed

"Sole proprietors, freelancers, and independent contractors who carry on a trade or business. A member of a partnership that carries on a trade or business may also be considered to be self-employed by the Internal Revenue Service" (Kagan, 2020).

"Self-employment tax is a tax-deductible expense. While the tax gets charged on a taxpayer’s business profit, the IRS lets him or her count the employer half of the self-employment tax, or 7.65% (calculated as half of 15.3%), as a business deduction for purposes of calculating the tax" (Kagan, 2020).

Social Security & Medicare Tax

"In any business, both the company and the employee are taxed to pay for the two major social welfare programs – Medicare and Social Security. When an individual is self-employed, s/he is both the company and the employee, so she pays both portions of this tax" (Kagan, 2020).

Social Security: "Assessed at a rate of 6.2% for an employer and 6.2% for the employee. A self-employed worker will be taxed 6.2% + 6.2% = 12.4%, of their net earnings up to $137, 700" (Kagan, 2020).

Medicare: "All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9%" (Self-Employment Tax, 2020). However, earnings above $200,000 ($250,000 for married couples filing jointly) are subject to an additional 0.9% Medicare tax" (Kagan, 2020).

"Workers who are self-employed aren't subject to withholding tax, but the IRS requires taxpayers to make quarterly estimated tax payments in order to cover their self-employment tax obligation. Self-employed people who make less than $400 from self-employment don't have to pay any tax.

Self-employment tax is computed and reported on IRS Form 1040 Schedule SE (Kagan, 2020).

Where to Pay FICA, Federal Withholding Tax, and Self-Employment Tax

"EFTPS is short for Electronic Federal Tax Payment System. It is a free service offered by the U.S. Department of the Treasury that allows you to pay federal taxes online or over the phone. EFTPS is used by businesses, individuals, federal agencies, tax professionals, and payroll services"

"If you are requesting a new Employer Identification Number (EIN) and indicate you will have federal tax payments, you are automatically pre-enrolled in EFTPS. The IRS will notify you about the pre-enrollment. Then, you can activate the account"

"If you are not pre-enrolled, you can sign up directly on the EFTPS website or by calling the EFTPS at 800-555-4477"

"You will need three pieces of information to enroll in EFTPS:

· A Taxpayer Identification Number (TIN): What is a TIN? The TIN can be your Social Security number (if you are a sole proprietor) or your business’s EIN.

· A bank account number and routing number: The bank account can be a personal or business bank account.

· Your name and address"

(Kappel, 2017).

Federal Unemployment Tax Act

"Federal Unemployment Tax Act (FUTA) provides funds for paying unemployment compensation to workers who have lost their jobs" Only employers pay FUTA tax. Do not collect or deduct FUTA tax from your employees' wages" (United States 2020).

Who Must Pay FUTA?

Use the following three tests to determine whether you must pay FUTA tax. Each test applies to a different category of employee, and each is independent of the others. If a test describes your situation, you’re subject to FUTA tax on the wages you pay to employees in that category during the current calendar year"

1. General test. You’re subject to FUTA tax in 2020 on the wages you pay employees who aren't farmworkers or household workers if:

a. You paid wages of $1,500 or more in any calendar quarter in 2019 or 2020, or

b. You had one or more employees for at least some part of a day in any 20 or more different weeks in 2019 or 20 or more different weeks in 2020.

2. Household employees test. You’re subject to FUTA tax if you paid total cash wages of $1,000 or more to household employees in any calendar quarter in 2019 or 2020. A household employee is an employee who performs household work in a private home, local college club, or local fraternity or sorority chapter.

3. Farmworkers test. You’re subject to FUTA tax on the wages you pay to farmworkers if: a. You paid cash wages of $20,000 or more to farmworkers during any calendar quarter in 2019 or 2020, or b. You employed 10 or more farmworkers during at least some part of a day (whether or not at the same time) during any 20 or more different weeks in 2019 or 20 or more different weeks in 2020 (United States, 2020).

"For 2020, the FUTA tax rate is 6.0%. The tax applies to the first $7,000 you pay to each employee as wages during the year. The $7,000 is the federal wage base. Your state wage base may be different. Generally, you can take a credit against your FUTA tax for amounts you paid into state unemployment funds. The credit may be as much as 5.4% of FUTA taxable wages. If you’re entitled to the maximum 5.4% credit, the FUTA tax rate after credit is 0.6%. You’re entitled to the maximum credit if you paid your state unemployment taxes in full, on time, and on all the same wages as are subject to FUTA tax, and as long as the state isn't determined to be a credit reduction state"(United States, 2020).

Depositing FUTA

"Determine your FUTA tax liability by multiplying the amount of taxable wages paid during the quarter by 0.6%. Stop depositing FUTA tax on an employee's wages when he or she reaches $7,000 in taxable wages for the calendar year. TIP If your FUTA tax liability for any calendar quarter is $500 or less, you don't have to deposit the tax. Instead, you may carry it forward and add it to the liability figured in the next quarter to see if you must make a deposit" (United States, 2020).

Deposit the FUTA tax by the last day of the first month that follows the end of the quarter. If the due date for making your deposit falls on a Saturday, Sunday, or legal holiday, you may make your deposit on the next business day. If your liability for the fourth quarter (plus any undeposited amount from any earlier quarter) is over $500, deposit the entire amount by the due date of Form 940 (January 31). If it is $500 or less, you can make a deposit, pay the tax with a credit or debit card, or pay the tax with your 2019 Form 940 by January 31, 2020. If you file Form 940 electronically, you can e-file and use EFW to pay the balance due (United States, 2020).

When to Deposit FUTA