.png)

What a Student Entrepreneur Should Know About Employment Tax

State Employment Taxes

Not all states have a state income tax. In fact, seven states, including Texas, DO NOT. States that do have state income taxes require employers to withhold those taxes from employees. Some states use the federal W-4 form, while other states have their own forms.

To collect income taxes in a state, you will need to register with the state's taxing authority to collect and pay these taxes you have withheld from employees (Murray, 2019).

The map to the right shows which states collect a state income tax and their highest income tax bracket percentages. To view all of the income brackets by state click on the "State Tax Brackets" button.

("Interactive State Income Tax Rate Map")

State Unemployment Taxes (SUTA)

("Image: Steps to Check Your State Unemployment Rate.")

Overview

In addition to federal unemployment taxes, most states require you to participate in the state unemployment tax plan and to pay state unemployment taxes.

State unemployment taxes are taxes assessed by states to cover unemployment benefits paid to unemployed workers who have been laid off or terminated by a company for specified reasons (Averkamp).

State unemployment tax is a percentage of an employee’s wages. Each state sets a different range of tax rates. Your tax rate might be based on factors like your industry, how many former employees received unemployment benefits and experience.

You pay SUTA tax to the state where the work is being done. If your employees all work in the state your business is located in, you will pay SUTA tax to the state your business is located in. But if your employees work in different states, you will pay SUTA tax to each state an employee works in.

States also set wage bases for unemployment tax. This means you will only contribute to the unemployment tax up until the employee earns a certain amount.

State unemployment taxes are referred to as SUTA tax or state unemployment insurance, or SUI. Or, they may be referred to as reemployment taxes (Blakely-Gray, 2019).

Texas Unemployment Taxes

The Unemployment Tax program collects wage information and unemployment taxes from employers subject to the Texas Unemployment Compensation Act (TUCA). The taxes support the state’s Unemployment Compensation Fund, a reserve from which unemployment benefits are paid to eligible workers who are unemployed through no fault of their own. Unemployment taxes are NOT deducted from employee wages ("Unemployment Tax Basics").

To view a searchable version of the Texas Unemployment Compensation Act click the button below:

(Texas Workforce Commission Emblem)

Most employers are required to pay Unemployment Insurance (UI) tax under certain circumstances. The Texas Workforce Commission uses three employment categories: regular, domestic and agricultural. Employer tax liability differs for each type of employment. For more information, see the Texas Workforce Commission's Definition & Types of Employment.

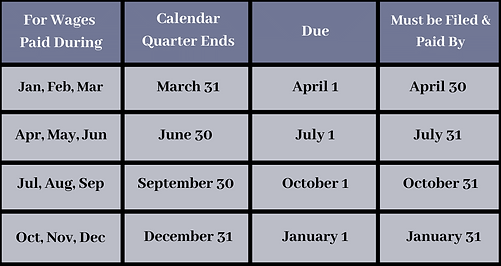

Liable employers must register with the Texas Workforce Commission (TWC) to create a tax account and in each calendar quarter, report wages paid to employees and pay taxes due. For state unemployment tax purposes, only the first $9,000 paid to an employee by an employer during a calendar year constitutes "taxable wages." Quarterly wage reports and taxes must be filed and paid by the last day of the month following the end of the calendar quarter. For detailed information see Reporting & Determining Taxable Wages, Employer’s Quarterly Wage Report

Filing Options and Payment Options for Unemployment Tax ("Unemployment Tax Basics").

How to Determine if a Worker is an Employee or an Independent Contractor

("Classifying Employees & Independent Contractors")

Businesses with employees are subject to the Texas Unemployment Compensation Act (TUCA) and are liable to pay unemployment taxes. If workers are independent contractors, the employer is not liable to pay unemployment taxes on those individuals. Employers who misclassify employees as independent contractors may be subject to fines and increased taxes and interest charges.

The law defines employment as a service performed by an individual for wages under an express or implied contract for hire, unless it is shown to the satisfaction of the Commission that the individual’s performance of the service has been and will continue to be free from control or direction under the contract.

The three essential elements of the definition of employment are service, wages, and direction and control. Direction and control can be present in an employment relationship even if the employer does not exercise direction and control, but retains the right to do so.

TWC uses a 20-point comparative approach as a guide to determine if a worker is an employee or an independent contractor ("Classifying Employees & Independent Contractors").

To view TWC's pdf version of the 20-point comparative approach click on the document to the left or the button to the left.

To read more about how to determine if a worker is considered an employee or an independent contractor and find examples of each, click the red button to the below.

What to do if you are a new employer in Texas:

1. Register for a New Unemployment Tax Account with the Texas Workforce Commission.

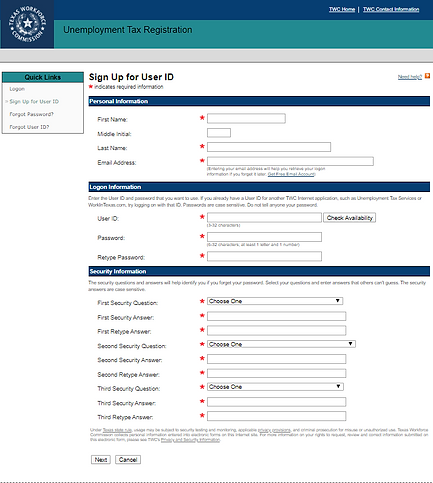

Employers must register with the Texas Workforce Commission (TWC) within 10 days of becoming subject to the Texas Unemployment Compensation Act. TWC provides this quick, free, online service to make registering as easy as possible. You will answer a series of questions about the ownership of the business and the number of locations operated. Once the registration is complete, liable employers will receive a TWC Tax Account Number and may be able to file wage reports and submit unemployment tax payments online.

The registration process takes approximately 20 minutes.

2. Report Employee Wages

Log on to your Texas Workforce Commission account and submit employers’ quarterly wage reports electronically in the month that follows each calendar quarter (April, July, October, and January). The wage report reflects the gross wages paid during the quarter and the total amount of taxable wages.

For each employee, provide a Social Security number, name and the amount of gross wages paid.

Employers or other entities reporting wages in any one calendar quarter are required to report electronically. The electronic reporting requirement also applies to agents reporting on behalf of multiple employers.

The Texas SUTA rate is 0.46-6.46 percent on the first $9,000 of an employee’s wages (based on how long the employer has been in business along with NAISC industry rates. **Click the button at the bottom of this page to see how TWC calculates rates). Remember, for state unemployment tax purposes, only the first $9,000 paid to an employee by an employer during a calendar year constitutes "taxable wages."

The following is an example of the amount of wages to be reported by an employer, assuming that he had only one employee for the year, who was paid $4,000 per month.

3. File Scheduled Tax Reports and Payments

In Texas, UI tax reports and payments are due a month after the close of each calendar quarter. In other words, UI tax reports are due by the dates shown in the chart below.

(Image: Example of Employer's Quarterly Report)

What information do I need to register?

All of the information below is required to complete the process and must be entered, so you should have it all on hand before starting. You may want to print this page before beginning the registration process.

Information needed to register:

-

Email address of business contact.

-

Payroll information including when the business first hired an employee, when the first wages were paid, and total quarterly wage payment amounts paid by the business for all locations.

-

If the business was acquired from a previous owner, you will need the name and address of the previous business owner.

-

Owners', partners' or officers' social security numbers and residence addresses.

-

The current United States mailing address for the registering entity.

-

The trade name and physical address of each business location in Texas.

-

Knowledge of the principal activities or products of the business.

(Due Dates for Employer’s Quarterly Reports & Payments)

If the due date for a report or tax payment falls on Saturday, Sunday, or a legal holiday on which TWC offices are closed, reports and payments are considered timely if they are received on or before the following business day (Steingold, 2015).

**For more information on how the Texas Workforce Commission calculates unemployment tax rates click the button below.

Penalties for Late Payments

Interest

In accordance with Section 213.021 of the TUCA, interest for late payment of taxes is assessed at a rate of one and one-half percent (1.5%) of the amount of tax for each month or part of a month elapsed after the final due date. Maximum interest = 37.5%.

Penalty

This is in accordance with Section 213.022 of the TUCA. If report is filed during the first 15 days after the final due date, the penalty is $15.00. If report is not filed during the first 15 days after the final due date, then one of the following computations will be used to calculate the penalty for a late report.

-

Report is filed after 15 days but no later than the last day of the month after the final due date

Taxable Wages (Item 14) × .05% + $30.00 = Penalty (Item 17)

-

Report is filed during the second month after the final due date:

Taxable Wages (Item 14) × .15% + $60.00 = Penalty (Item 17)

-

Report is filed during or after the third month after the final due date:

Taxable Wages (Item 14) × .35% + $90.00 = Penalty (Item 17)

Click the button below to go to the Texas Workforce Commission's website to view their helpful computation worksheet.